Subtotal ₹0.00

Overview

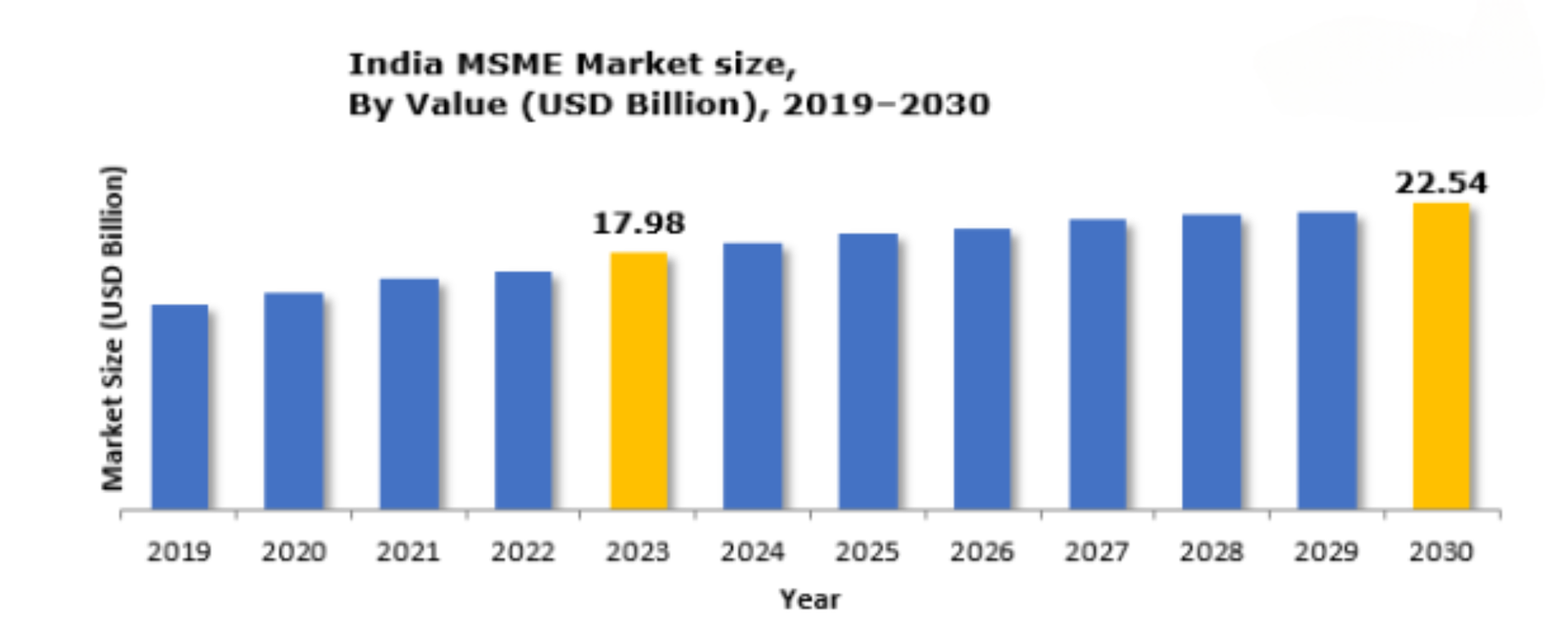

The Indian Micro, Small, and Medium-sized Enterprises (MSME) market is a dynamic sector with significant contributions to the country’s economic growth, employment, and industrial production. As of 2023, the India MSME market size is estimated at USD 17.98 billion, with projections indicating a growth to USD 22.54 billion by 2030. This growth represents a robust compound annual growth rate (CAGR) of 8.54% from 2024 to 2030. Key drivers include government initiatives, digitalization, and the sector’s role in employment and GDP.

Key Market Drivers

- Growing Workforce and Economy: The MSME sector is pivotal in expanding India’s workforce and driving economic growth. It accounts for over 40% of industrial production and 42% of exports. The sector’s dynamism, particularly in Tier-2 and Tier-3 cities, is enhancing job creation. Government initiatives like Udyam registrations aim to add 5 crore jobs in the MSME sector by 2025.

- Government Support: The Indian government has implemented several programs to support MSMEs, including the Credit Guarantee Trust Fund for Micro and Small Enterprises (CGTMSE) and the Emergency Credit Line Guarantee Scheme (ECLGS). The Aatmanirbhar Bharat Abhiyaan Scheme has revised MSME definitions, while initiatives like the Government e-Marketplace (GeM) foster digital transactions and entrepreneurship.

- Digitalization: Digitalization has opened new avenues for MSMEs. Initiatives like ‘Digital India’ have facilitated access to e-commerce, digital marketing, and financial services. As digital payments grow, with 72% of transactions now digital, MSMEs are better positioned to leverage technology for growth.

Challenges

- Infrastructure Disparities: Healthcare infrastructure gaps impact MSME growth, particularly in rural areas where access to quality healthcare is limited. This disparity affects the sector’s overall attractiveness and growth potential.

- Geopolitical Tensions: Geopolitical instability can disrupt supply chains and affect export opportunities for MSMEs. Such tensions may also impact operational costs and investor confidence, necessitating diversification and resilience in MSME operations.

Market Segmentation

- By Size:

- Micro Enterprises: The largest segment, characterized by small-scale operations and investments not exceeding INR 10 million.

- Small and Medium-sized Enterprises: Contributing significantly but with a smaller share compared to micro enterprises.

- By Industry:

- Manufacturing: Includes textiles, food processing, and chemicals.

- Services: Comprises IT, tourism, education, and healthcare, with the services segment holding the highest market share due to less capital intensity and growing demand.

- Trading: Encompasses wholesale and retail trade businesses.

- By Region:

- North India: Dominates with a significant share, driven by the National Capital Region (NCR) which includes Delhi, Uttar Pradesh, Haryana, and Rajasthan. This region has a high concentration of micro and small enterprises and substantial investments.

Competitive Landscape

Prominent players in the India MSME market include Varroc Engineering, Orient Craft, Assam Carbon Products Ltd, and others. These companies employ strategies such as mergers, acquisitions, and new product launches to expand their market presence.

Boost Your MSME Revenue with Tryidol Technologies

Tryidol Technologies offers tailored IT solutions to enhance efficiency, streamline operations, and drive revenue growth for MSMEs. Our custom software and automation tools optimize workflows and reduce costs. Contact us at saif@tryidoltech.com to discover how we can support your business success.

Comments are closed